Cyber Staking = Governance + Network Security + Economic Rewards

Staking is not available in restricted countries, including the US, Canada, China, Iran, North Korea, the Syrian Arab Republic, and Cuba.

Cyber staking enables CYBER holders to stake their CYBER tokens, thereby securing the network, while granting them economic rewards and voting rights. This not only bolsters network security but also democratizes governance, allowing users to actively participate in decision-making processes.

Economic Rewards for Stakers

5,500,000 CYBER has been initially allocated over the next several years to attract stakers with compelling rewards and ensure the long-term sustainability of network staking. Moving forward, staking rewards each year will be determined through DAO governance and are subject to change. However, significant staking rewards are anticipated.

Voting Rights for Stakers

Staked CYBER, via derivative tokens cCYBER and stCYBER, grants holders the ability to submit and vote on governance proposals, directly influencing the ecosystem's future. To participate in governance, CYBER holders must stake their CYBER and hold cCYBER or stCYBER.

How CYBER Mainnet Staking Works

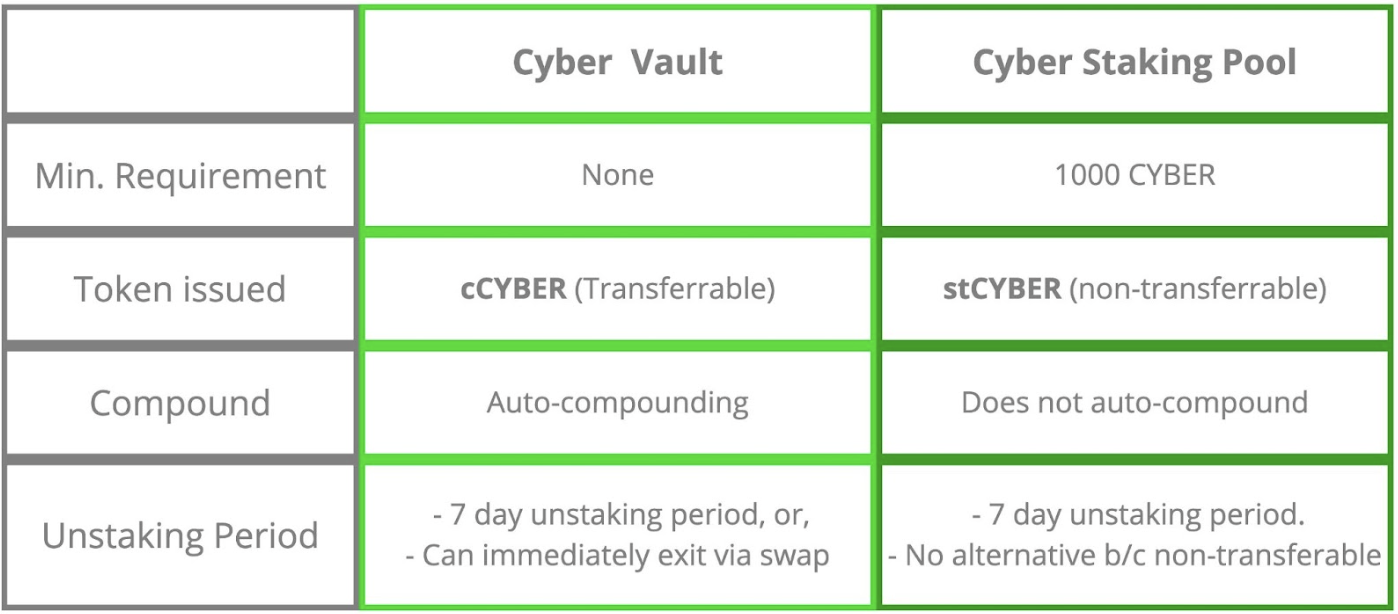

CYBER holders have two primary staking options: the Cyber Vault and Cyber Staking Pool contracts. Both options distribute rewards programmatically based on predefined rules, with the total staking rewards shared between users of both the Cyber Vault and Cyber Staking Pool.

Both options issue tokens to stakers that represent their staked CYBER, enabling them to participate in governance while staking. Users of the Cyber Vault receive cCYBER, which is transferable and benefits from auto-compounded rewards. Users of the Staking Pool receive non-transferable and non-auto-compounding stCYBER.

Cyber Vault

The Cyber Vault is an EIP-4626 Vault contract that simplifies and enhances accessibility for staking on Cyber Mainnet. It offers auto-compounding, no minimum stake requirements, and instant liquidity through cCYBER.

The Cyber Vault operates similarly to stake management facilitators on Ethereum. It automates claiming and staking rewards, increasing the efficiency of staking. The Cyber Vault charges a 10% fee on rewards, which is used to fund the Cyber Treasury to support future rewards and to sustain ecosystem growth. This fee is comparable to most Staking-as-a-Service providers.

Staking Pool

The Staking Pool is a direct staking contract designed for holders with at least 1,000 CYBER. It offers a more hands-on approach with some additional restrictions, such as not offering auto-compounding or instant liquidity. This option may suit those who are more technical and hold significant amounts of CYBER.

Compared to the Cyber Vault, the Staking Pool offers a more involved staking experience that requires manual interaction with smart contracts. Using the Staking Pool on Cyber Mainnet can be thought of as similar to direct staking on Ethereum which has additional requirements, including a minimum stake of 32 ETH and running a node.

Unstaking

Holders of stCYBER and cCYBER typically face a 7-day unstaking period when unstaking their staked CYBER. However, because cCYBER is transferable, holders can immediately exit their staking position by swapping the asset on a DEX. In contrast, because stCYBER is non-transferable, therefore this immediate exit option is not available to its holders.

Legal Disclaimer The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any CYBER, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.